do i pay taxes on an inherited annuity

Many times assets are worth more at the owners death than when first acquired but annuities have no change in value one transferred to the beneficiary. If it seems like everything is subject to an inheritance.

How To Figure Tax On Inherited Annuity

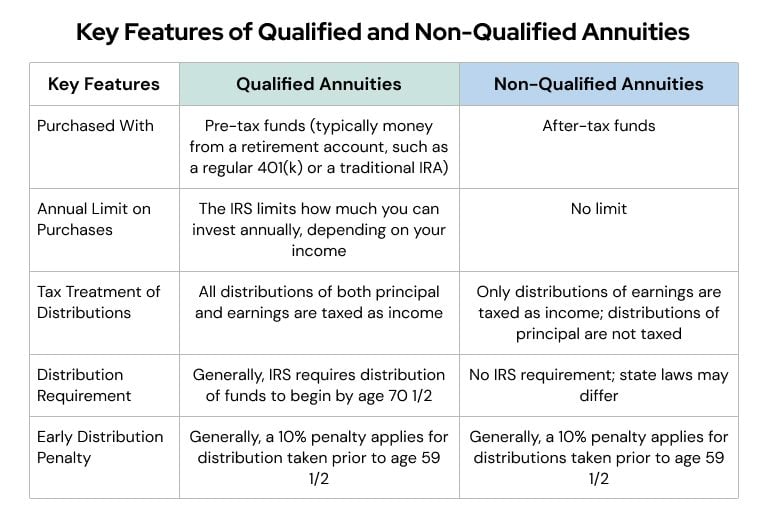

Since the owner didnt pay taxes on any of the money all of the death benefit withdrawals are considered income.

. Therefore you only pay taxes on the. If you inherit an annuity you may have to pay taxes on your money. Your beneficiaries have a few options for dealing with the inherited annuity -- and the tax bill it triggers.

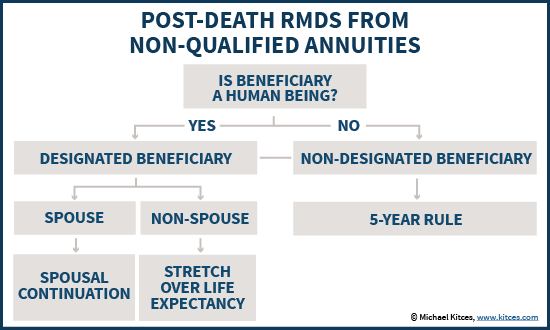

Just like any other qualified account such as a 401 k or an individual. If you are the beneficiary and inherit an annuity the same tax rules apply. Only a spouse can inherit an annuity and benefit from the options the late.

When do you pay taxes on an inherited annuity. Only a spouse can inherit an annuity and benefit from the options the late. Because your wife chose to cash in the annuity a portion of what she received will be income from the invested funds.

Only a spouse can inherit an annuity and benefit from the options the late. Yes there are taxes due on inherited annuities. So when you inherit a qualified annuity Uncle Sam comes calling.

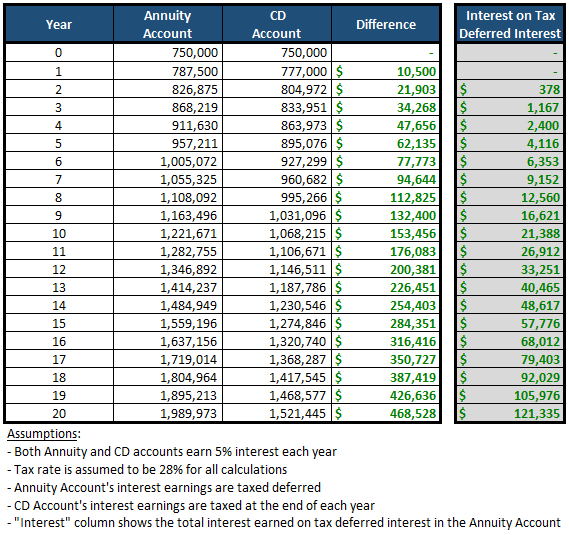

Although you will not owe taxes on the principal or the amount your father paid into the annuity you will owe taxes on the interest the premium has earned. The simplest option is to take the entire amount as a lump sum. Inherited Non-Qualified Annuity Taxes Because the annuity purchaser invested after-tax dollars the principal isnt taxed when distributed.

If you keep the annuity you will usually have to start taking. Whether or not an inherited annuity is subject to inheritance or estate tax the beneficiary is liable for income tax. The period of time when an annuity is being funded and before payouts begin is referred to as the accumulation phase.

The lump sum is taxed at ordinary income tax. The earnings are taxable over the life of the payments. The main rule about taxation with an inherited annuity or one that is purchased is that any principal that is funded.

You may also have to pay fees to cash out the annuity. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income. The amount depends upon your relationship to the deceased and the value of the annuity.

In this case taxes are owed on the entire difference between what the original owner paid for the annuity and the death benefit. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income. When inheriting an annuity from a parent you will have to pay taxes on payments as ordinary income.

What Is The Best Thing To Do With An Inherited Annuity Due

Do I Have To Pay Taxes When I Inherit Money

How Are Inherited Annuities Taxed

A Break For Inherited Annuities Retirement Watch

Layin It On The Line How Are Inherited Annuities Taxed Cedar City News

Annuity Taxation How Various Annuities Are Taxed

:max_bytes(150000):strip_icc()/success-1093889_1920-73785c60ea884a3eb06341d5e7422b07.jpg)

How Are Nonqualified Variable Annuities Taxed

Are Inherited Annuities Exempt From Federal State Taxes

Mom Is Worried About Tax Hit From Annuity

How To Avoid Paying Taxes On An Inherited Annuity Weny News

What Taxes Are Owed On Inherited Annuity Njmoneyhelp Com

Trust Vs Restricted Payout As Annuity Beneficiary

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxes Distribution

Is Annuity Inheritance Taxable

Annuity Tax Consequences Taxes And Selling Annuity Settlements

Do I Have To Pay Taxes On An Inherited Annuity Mastry Law Estate Planning

381 Annuities That Offer A Death Benefit The Annuity Expert 2022

Inheritance Annuities Know Your Annuity Contract Transamerica