deloitte work from home allowance

First of all congrats on joining Deloitte USI. Deloittes Total Rewards and Benefits program offers a comprehensive variety of programs and resources to support the life journey of our professionals.

Is Deloitte Usi Providing Welcome Kits To New Joiners Lateral Hires Coming In After March 2021 If Yes What Does It Include Also Are They Eligible For Any Work From Home Allowance

In order for employees to deduct employment expenses from their income including home office expenses employees must be required to work from home and to bear the expenses.

. I have anxiety and depression. Its always something there usually bad. No matter where your organization may fall within these results and how it approaches remote work Deloitte professionals can help with your remote work strategy policy and operations.

Deloitte 300 subsidy for necessary work from home equipment though some offices are reporting an allowance of 500. In response Inland Revenue have extended their guidance on the level of tax-free allowances employers can pay to cover increased expenses as a consequence of working from home. Yes it exists but it depends of which Deloitte practice and project one is in.

Does Deloitte provide work from home allowance to new joiners. In addition to household expenses other amounts that. Those working from home may want to claim a deduction on their personal income tax return for home office expenses incurred.

Generally it takes the form of 23 days of work from home and remaining from office based on. We are Deloitte includes many elements for example. Its designed to help workers cover their expenses while working remotely.

Work from home setup allowance is provided. It also reflects our continued commitment. Answer 1 of 4.

There is a provision of one time productivity reimbursement given to all the employees due to this work from Home situation. An increasing number of people are working from home on a regular basis regardless of any Government-mandated requirement to do so. At Deloitte our people are our greatest asset.

You can create an entry for expense in DTE and you can keep adding your bills and edit the total amount. We initiated a work-from-home technology subsidy of 500 and a temporary expansion of reimbursable commuting expenses to enhance hybrid work further enable the transition to new ways of working and to help our professionals feel safe connecting with each other in person. You are currently posting as works at.

That will be easier to maintain for you too. For the New Hires it is to be claimed within the 45 days of joining the Firm. Soon to be 2 support since my homie is leaving me.

Companies are paying for their remote employees desks chairs and computers and are instituting regular allowances for WiFi and phone costs. Answer 1 of 3. The costs of meals can be reimbursed on a tax-free basis where the employee is required to work away from their normal place of work.

If yes how much. This is a short. Plus its written that earbuds are not part of Productivity allowance but Well being subsidy.

Go to My Technology Collaboration Central Virtual Presence Coaching Find out more about the new 500. Household expenses that may be included in your home office tax deduction include your bond interest or if you are renting a house the rent payable by you rates and taxes electricity insurance domestic workers wages cost of repairs etc. You are currently posting as works at.

A remote work allowance or remote work stipend is a monetary sum paid to employees. If the WFH situation remains the same for the coming months as well Which is highly likely you guys should also receive the. I work for a small firm 2 attorneys and 3 support staff.

Although Im sure everyone around here would love to say firms are just cheaping out on meals this year and blaming the. WFH allowance WFH set-up reimbursement. Welcome kit is provided to campus placements only.

Employees to work from home. After joining you will get an email with details like how much can be reimbursed and procedure to do that. Any other joining benefits.

Once one completes confirmation based on manager confidence one may avail this facility. From we are Deloitte open the Empowering your transition to hybrid work virtual presence coaching. Lateral hires get Laptop charger headphones and a laptop bag based on stock availability.

Working from home can have many benefits for both employees and employers. Examples and Templates for Asking Your Boss to Work From Home. Deloitte recommends that an additional deduction of work from home allowance of Rs 50000 be given to employees in India too who are working from home.

By Andrea Scatchard and Jess Wheeler. Deloitte said it would also hand a 500 allowance to 6000 recent hires so they can buy equipment for working from home taking its total spending on homeworking kit to more than 10m since the. It will then tell you if you have 500 or not.

In view of the pandemic offices. Where this is in the form of a temporary change of workplace for a period of time the reimbursement can be made tax-free for up to. On top of heightened life situations the.

One growing answer. If you mean the 500 bucket for WFH equipment it is getting phased out soon so Im not sure if theres a cutoff for new employees using it - go into Manual Expense in DTE and see if it will let you choose Hybrid Productivity Allowance from the expense type dropdown. Our work-from-home survey results bore out this phenomenon as organizational responses to a range of questions display a range of approaches.

The term remote work allowance can also be used to refer to tax deductions that remote employees can claim but well cover this in more detail later. Learn about Deloitte Work From Home including a description from the employer and comments and ratings provided anonymously by current and former Deloitte employees. In this article we cover 20 productivity tips for working from home that you can use to stay productive boost your remote performance and keep yourself motivated throughout your workday.

Incurred in respect of the home office. We care about our people and we want them to be successful in their professional and personal lives. Glassdoor is your resource for information about the Work From Home benefits at Deloitte.

The dynamic in the office is terrible. As far as we know none of the big firms are providing any meal reimbursements for staff working from home as a rule. Folks with Deloitte - Came across this USI Hybrid Productivity Allowance Program - The program is effective for the period September 28 2021 through May 28 2022 with a purchase date b more 1 reactions.

Work From Home Allowance September 2020 Tax Alert

Deloitte Recruitment Deloitte Work From Home Job In Hindi Latest Jobs 2022 Karrar Hussain Jobs Youtube

Budget 2022 Keeping Eyes Peeled For Tax Benefits On Wfh Allowance Businesstoday

Budget 2022 Expectations Tax Cuts Wfh Relief On Taxpayers Wishlist

Give Tax Exemption To Work From Home Expenses Suggests Deloitte

We Are Deloitte Employee Benefits Deloitte Us

Does Deloitte Provide Work From Home Allowance To New Joiners If Yes How Much Any Other Joining Benefits Fishbowl

What Would Be The Take Home Salary For The Below Breakup In Deloitte India 1 Will The Pf Deduction Be Only Once 14500 Or Will It Happen Twice I Read Somewhere That

Cc Offers 400 Remote Working Allowance As Deloitte Legal Proposes Reduced Hours Law Com International

Third Of Staff May Work From Home Permanently Post Covid Deloitte Report Business Standard News

Is There A Wfh Allowance In Ey Gds Life 15k In Deloitte Usi Fishbowl

Deloitte Recruitment Deloitte Work From Home Job In Telugu Latest Jobs 2022 V The Techee Youtube

What Would Be The Take Home Salary For The Below Breakup In Deloitte India 1 Will The Pf Deduction Be Only Once 14500 Or Will It Happen Twice I Read Somewhere That

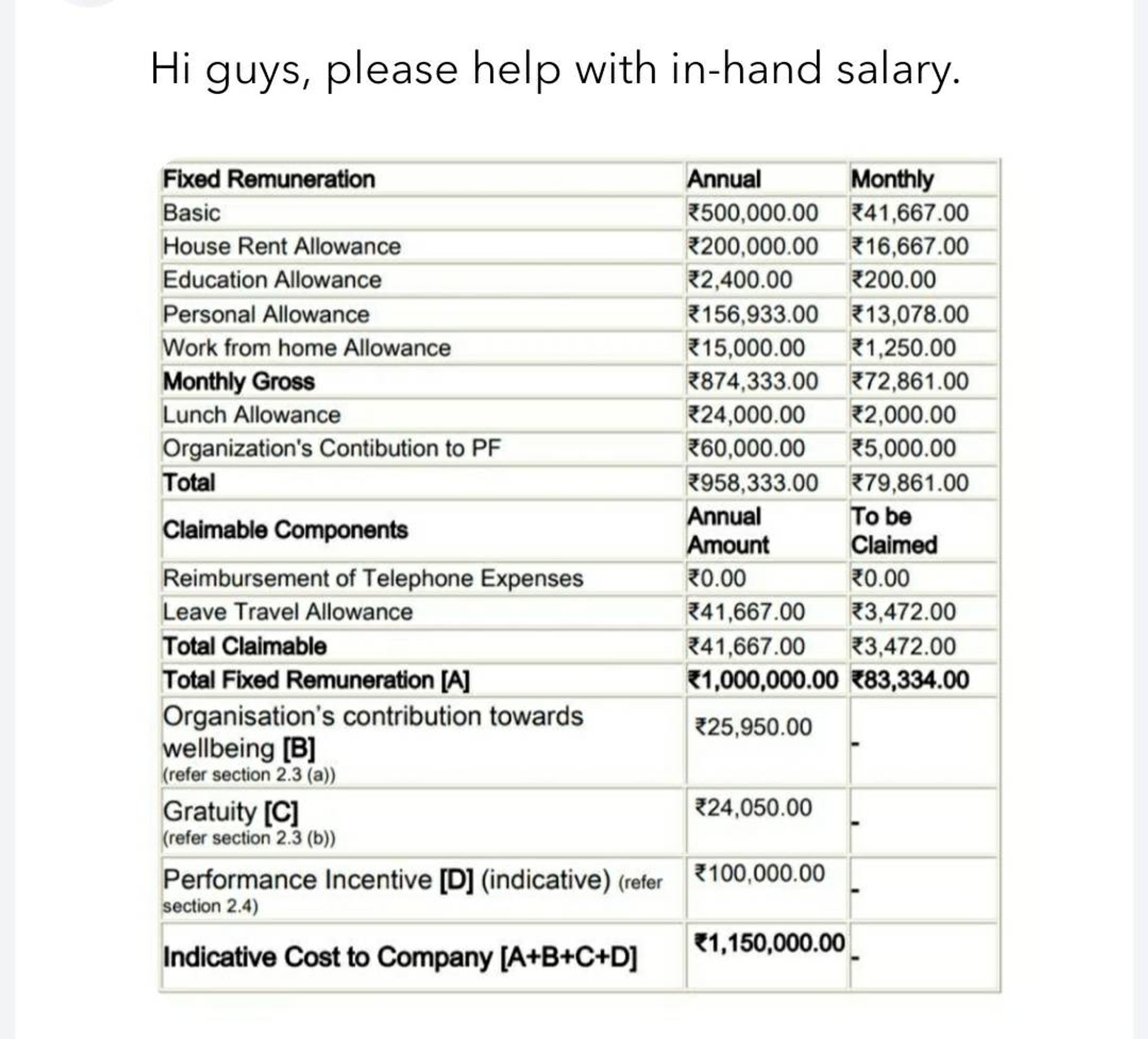

Please Help With In Hand Salary Calculation Deloitte India Deloitte Fishbowl

Deloitte To Shut 4 Offices To Transfer All Staff To Permanent Work From Home

Hey Fish Can Someone Explain A Couple Of Things In My Offer From Deloitte Usi Communication Expenses Are Capped At 3k Mo But I Ve Heard It S 1 5k Mo Fuel Expenses Are Capped At 1 8k

Budget 2022 Will The Work From Home Allowance Be Included In The Budget To Meet The Expectations Face Employees Budget 2022 Salaried Employees Looking For A Work From Home Allowance Pipanews Com